Wondering when it’s a good time for you to get a HELOC?

While economic conditions are changing constantly and everyone’s financial situation is slightly different, there are certain times that opening a HELOC just makes sense.

Here Are 8 Good Times to Get a HELOC:

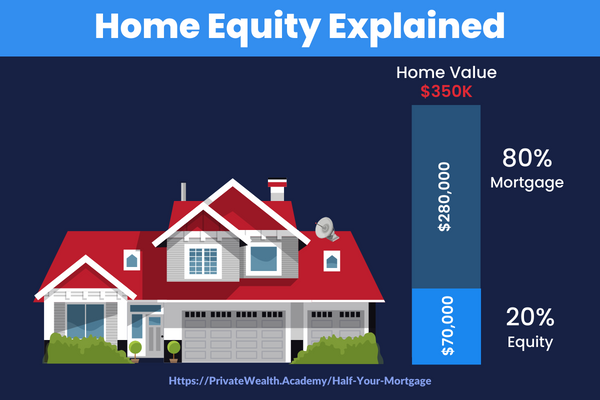

1. When You Have Decent Equity in the Home

If you’ve made a large down payment or you’ve been in your home for years, chances are you have a good amount of equity.

That means you’re sitting on tens of thousands of dollars (or more) that you can tap into like cash.

If you have at least 10-20% equity in your home – you can apply for a HELOC (even if you just bought the home 30 days ago!)

The more equity you have, the more you can borrow. Considering that many lenders will allow you to take out 80-90% or more of your equity, means there’s a substantial amount of money you can access like cash right now.

Just imagine having $50,000, $100,000, $250,000 or more to pay off your home, make repairs, fund major purchases like other properties, or simply to use as an emergency fund. All by using the equity you already have in your home.

2. When Home Values Are High

When interest rates go up, the effect on home values can fluctuate. While some home values are making a correction, others are still high (or even rising!) The more your home is worth, the more your HELOC can potentially get approved for.

If your home value increases, you’ll be able to get a higher line of credit.

This is exactly why NOW is a great time to open a HELOC.

Remember, the Loan-to-Value ratio is based on your home’s current value, not the amount you’ve paid. So if you’ve only paid 15% to 20% of your initial home mortgage – but the value of the home has since risen, the appraisal may help you get approved for a higher HELOC limit.

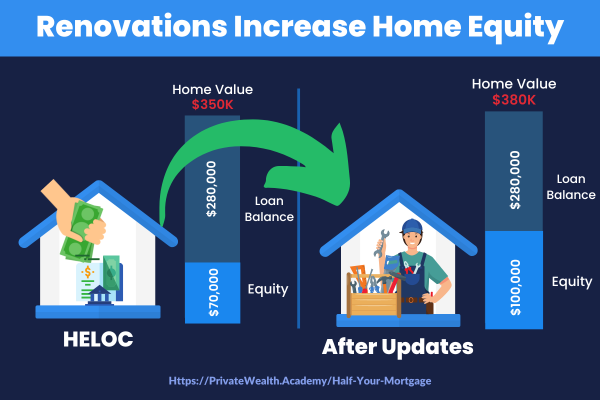

3. When It Will Be Used For Home Repairs

Using the equity you’ve paid into your home to further increase its value by making repairs or updates just makes sense. You’re essentially using your current equity to further increase the equity in your home. There’s really no down side to this as long as the updates you’re making actually add value to the home.

4. When You Want to Take Advantage of the Tax Deduction..

Another major benefit of using a HELOC for home improvements is that the interest can be tax deductible. As long as you use the funds to buy, build, or substantially improve your primary or second home

you can deduct up to $750,00 in total interest when filing your annual tax return.

5. When You Need To Pay Off High-Interest Debt

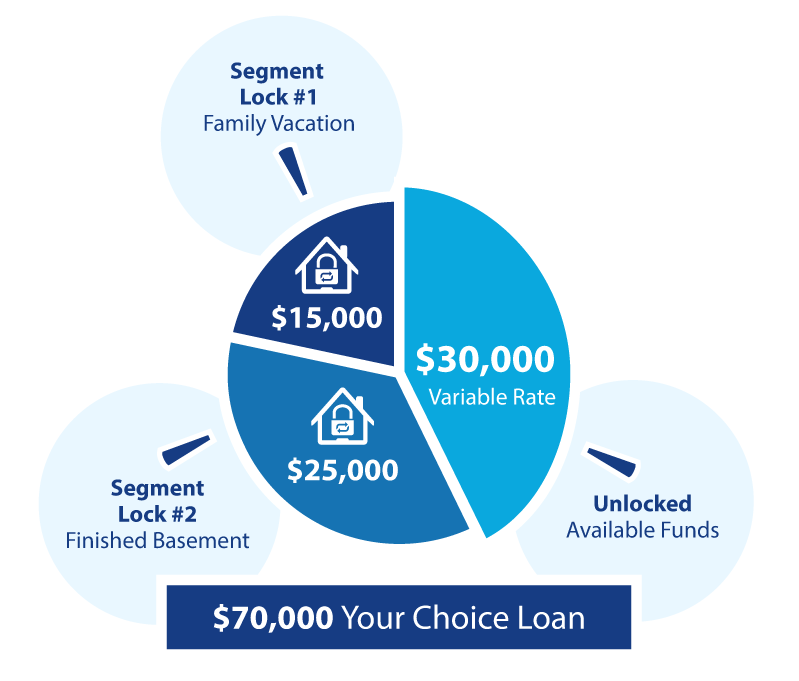

Tired of insanely high credit card interest rates? Like 18%, 20%, we’ve even seen some as high as 29%! If you are drowning in high-interest debt with no end in sight then consider paying it off with a HELOC. HELOCs generally have lower rates (APR) than unsecured loans like credit cards or personal loans because they’re secured by your home equity. 5% to 11% are pretty standard HELOC rates (depending on your credit history and other factors.)

Unlike virtually every other type of loan that’s a one-time lump sum (with interest accrued on the entire loan amount) – HELOCs only charge interest on the portion you use. This lowers the amount you pay and prevents you from taking on more debt than necessary.

As you can see this form of credit is a smarter choice, especially when it comes to making larger purchases. This lower rate and the ability to pay down principal whenever you choose without penalty, is what sets this apart from other funding options.

Most HELOCs allow for rate lock-ins so you can capture a better rate when interest rates fall.

6. Emergency Expenses

If you had an emergency expense, where would you get the money? If you don’t have savings or the money to take care of a sudden emergency, a HELOC can help you access the cash without having to sell your home, taking out a second mortgage or paying an arm and a leg in interest.

7. If You Want Fewer Fees & Costs Than A Mortgages

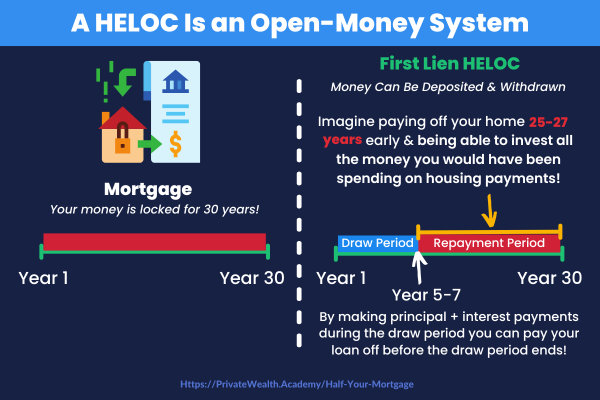

In general, first lien HELOCs come with less extra costs than mortgages or other refinancing options. Closing costs are often paid for by the lender, don’t require private mortgage insurance, mortgage points, doesn’t compound interest monthly and usually comes with no annual fees.

8. If You Want to Pay Off Your Home FAST

Thanks to their incredible flexibility, and the fact that HELOC interest is accrued on a daily balance (instead of compounding monthly) and that you can make additional principal payments without penalty – allows you pay off the loan in 5-7 years (saving you THOUSANDS in interest at the same time!)

There are NUMEROUS benefits to paying off a home quickly but think of it as a fast-track to TRUE homeownership and freedom. The ability to…

- No longer have to make home payments – own your home free & clear!

- Live debt-free

- Invest more (and sooner) than you ever thought possible!

Worried you won’t be able to lock in a low interest rate?

The first lien HELOC is a great financial tool with just about any interest rate because of its flexible repayment options.

Whether you’re looking to save money in interest, pay off debts, invest in real estate, or you’re looking to boost your rainy-day fund in case of emergency, the HELOC is a great choice. Click the link below and let us help you secure the right HELOC so you can pay off your home FAST!

The Half Your Mortgage program will help you find the right first lien HELOC for you, teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to find the best HELOC lenders, lock-in the best rates and so MUCH MORE! Click the link below to pay off your home in 5-7 years:

Learn More About the Half Your Mortgage Program

Have you held back because you’re not quite sure a HELOC is right for you? We’ll help you answer this and more in tomorrow’s email. In the meantime…

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing.) We’ll run through the numbers with you using our proprietary software and see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call today!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.