Wondering which lenders offer the best HELOC rates?

While some big banks DO offer HELOCs…

Regional banks and credit unions tend to offer the lowest rates and best terms (not to mention a more personable, human touch.)

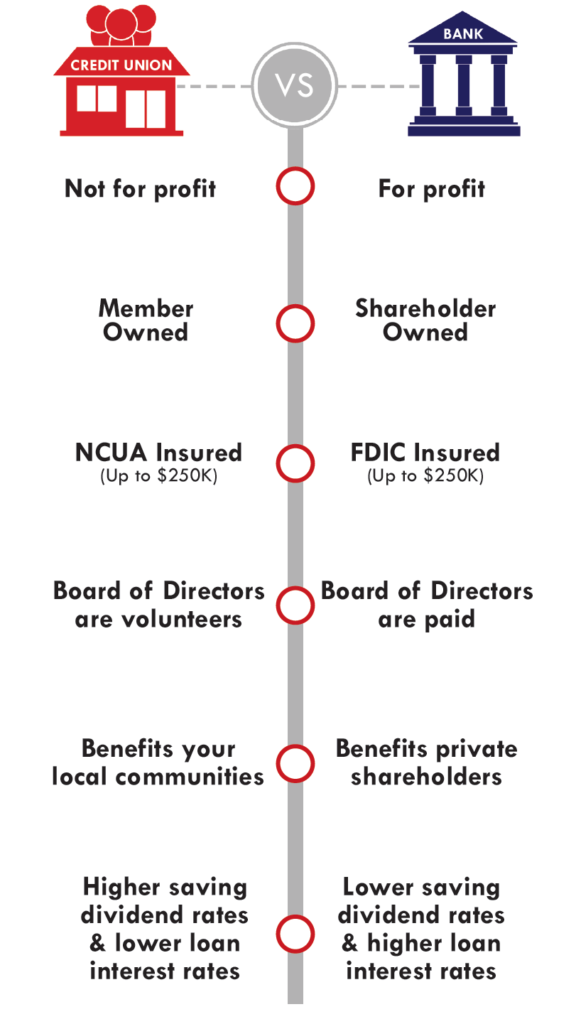

Here are just a few reasons you may want to also consider starting your search for a HELOC at your local credit union vs. a larger bank.

Who Offers the Best HELOC Rates?

1. Credit Unions Are Local, Not-For-Profit Institutions

A credit union does not have shareholders to dole out profits to, so that money can be passed along to its members in the form of lower rates and fees as well as higher dividends.

2. HELOC Rates are Typically Lower at a Credit Union vs Bank

In terms of saving money on loans, the differences can be substantial. Banks generate a great deal of their profits by charging their own customers the highest possible interest rate based on their qualifications.

However the mindset at a credit union is the opposite. When taking out a HELOC or other product, professionals at credit unions work to ensure you are matched with the best solution for your needs. They also work to provide the lowest interest rate possible for their members.

3. HELOC Fees are Typically Lower at a Credit Union vs Bank

Working families often join their local credit union because the not-for-profit business model allows management to focus on offering reduced fees to their members. While banks can charge fees to gain extra income, credit unions are always aiming to charge the lowest possible fee to cover the service, not to make extra money.

4. HELOC Applications Are Available Online

Credit unions ensure easy access when it comes to applying for a HELOC by keeping the process easy and convenient with online HELOC applications. They also know you have a busy schedule.

However, the ability to fill out a HELOC application online and receive a prompt response from a credit union enhances the customer experience. Credit unions also pride themselves on customer service.

5. Credit Unions Offer Faster Processing & Local Decision-Making

Lengthy approval processes are frustrating. When considering the credit union vs bank timeline, the former historically outperforms the latter. Their goal is to provide low or no-cost financial resources efficiently while offering outstanding customer service. They typically have their own underwriters on staff processing the applications and also approvals quickly. That’s why credit unions also typically process HELOC loans much faster.

6. HELOC Questions Are Answered with Your Best Interest in Mind

The professionals who work at a credit union possess the experience to help you navigate the HELOC process.

7. Working with a Credit Union Means Supporting Your Local Community – When you join a credit union and take out a HELOC, the money is reinvested in YOUR community. The pool of money a credit union accumulates from residents helps create low-interest opportunities and sometimes no-cost services.

Lenders are a dime a dozen and offer a variety of different options but when shopping for a HELOC it is important to ensure…

it’s the HELOC in the first lien position, offers a daily sweep account, has affordable interest rates, minimal fees, no prepayment penalties and also the best terms to suit your needs.

If you feel overwhelmed or simply want help finding the best HELOC offers in your state – the Half Your Mortgage program is for you!

We’ll show you how to… prepare your finances, boost your credit score,

calculate your debt-to-income ratio, get the right criteria your HELOC needs,

compare lenders, the questions to ask to ensure you’re getting the

best deal, what to do in the event you get denied and much more!

You’ll also get access to our proprietary calculators to make the math super-duper easy. A list of state-specific lenders that will save you hours of research time. Plus, our proven HELOC Hyperdrive Strategy that will show you how to pay off the loan in as little as 3 years. Click the link below to get started today:

Isn’t it time to start making your equity work for you?

Learn More About the Half Your Mortgage Program

Not quite ready yet? No problem!

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage. Click to schedule a call.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.