Did you know there are two different types of HELOCs?

There are first lien HELOCs and the more common second lien HELOCs.

Over the past week we’ve also gone into detail about the various benefits that a HELOC can offer.

However, not just any HELOC will provide you with all these benefits…

- The first mortgage or home loan that you took out to buy your property are your primary mortgage (this is in the first lien position).

- Traditionally, HELOCs are a type of second mortgage or a second lien on a home – taking place after the first mortgage.

With refinancing one may adjust their current mortgage; whereas second mortgages typically do not affect the primary mortgage loan terms. *We’ll get into this more another day.

However, there is another type of all-in-one HELOC that allows you to…

REPLACE your mortgage and access up to 100% of your equity, not just the amount of a smaller second mortgage HELOC.

This is known as a First Lien HELOC. *This is the type of HELOC you want to get. A First Lien HELOC is a combination of a mortgage and also a home equity loan. It takes the place of a primary mortgage.

A First Lien HELOC is Best!

It allows money to go in and out freely. It’s the fastest and easiest way to use your equity like cash. Like the ultimate credit card. It doesn’t compound interest like a mortgage!

So just to clarify…

Second Lien HELOCs: A second lien HELOC is subordinate to your first mortgage and is often used for consolidating debt, funding home improvement projects, or other major expenses.

First Lien HELOCs: A first lien HELOC takes priority over all other loans on your home, and replaces your primary mortgage.

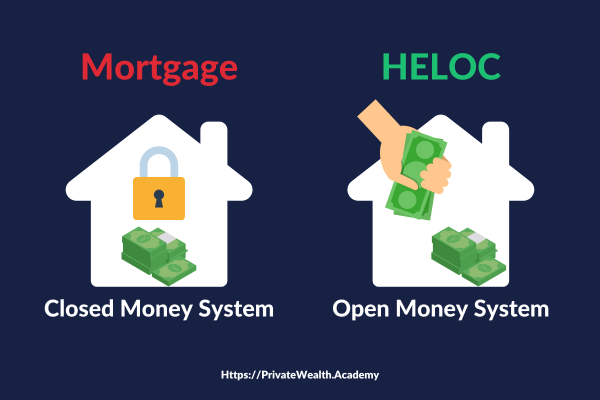

A traditional mortgage is a rigid financing obligation that locks you into virtually the same payments for 15 or 30 years without the ability for you to pay off your home faster (even if you make additional payments on the principal).

A First Lien HELOC on the other hand can give you quick access to cash, help you consolidate debt at an affordable rate, and help you pay off your home loan fast.

How A First Lien HELOC Saves You the Most Money…

First Lien HELOCs are a much better solution than a second mortgage, or even a first mortgage. Second Mortgage interest rates tend to run higher than HELOCs (especially First Lien HELOCs) because a second mortgage compounds interest rates.

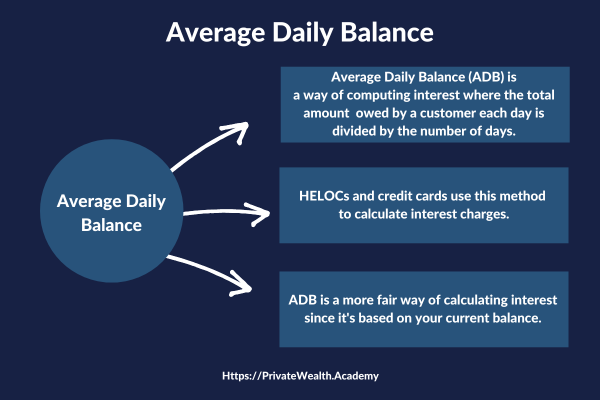

Traditional mortgages calculate your interest using an amortized interest calculation which compounds your interest payments.

As its name implies, your interest payment is calculated daily, using that day’s principal balance. So, by decreasing your balance, even at a daily level, your interest payment decreases overall.

Tomorrow we’ll be sharing the ways lenders use mortgages like scams to trick us into paying DOUBLE for a house – the most expensive asset most of us will ever own!

By using a first lien HELOC and the Hyperdrive Strategy we teach inside the Half Your Mortgage program, you can pay off your home in as little as 5-7 years without changing your income or lifestyle.

Inside, we’ll take you through the process of securing the right HELOC for you. We’ll show you how to prepare your finances, calculate the interest (so you know how much you’ll be saving), compare lenders, the questions to ask to ensure you’re getting the best deal and much more!

Learn More About the Half Your Mortgage Program

Want to speak to one of our team members? We’re here to help…

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.