Curious what requirements you need to get approved for a HELOC?

Today we wanted to quickly review the basic HELOC requirements you’ll need to qualify.

Luckily a home equity line of credit is easier to get approved for than a mortgage.

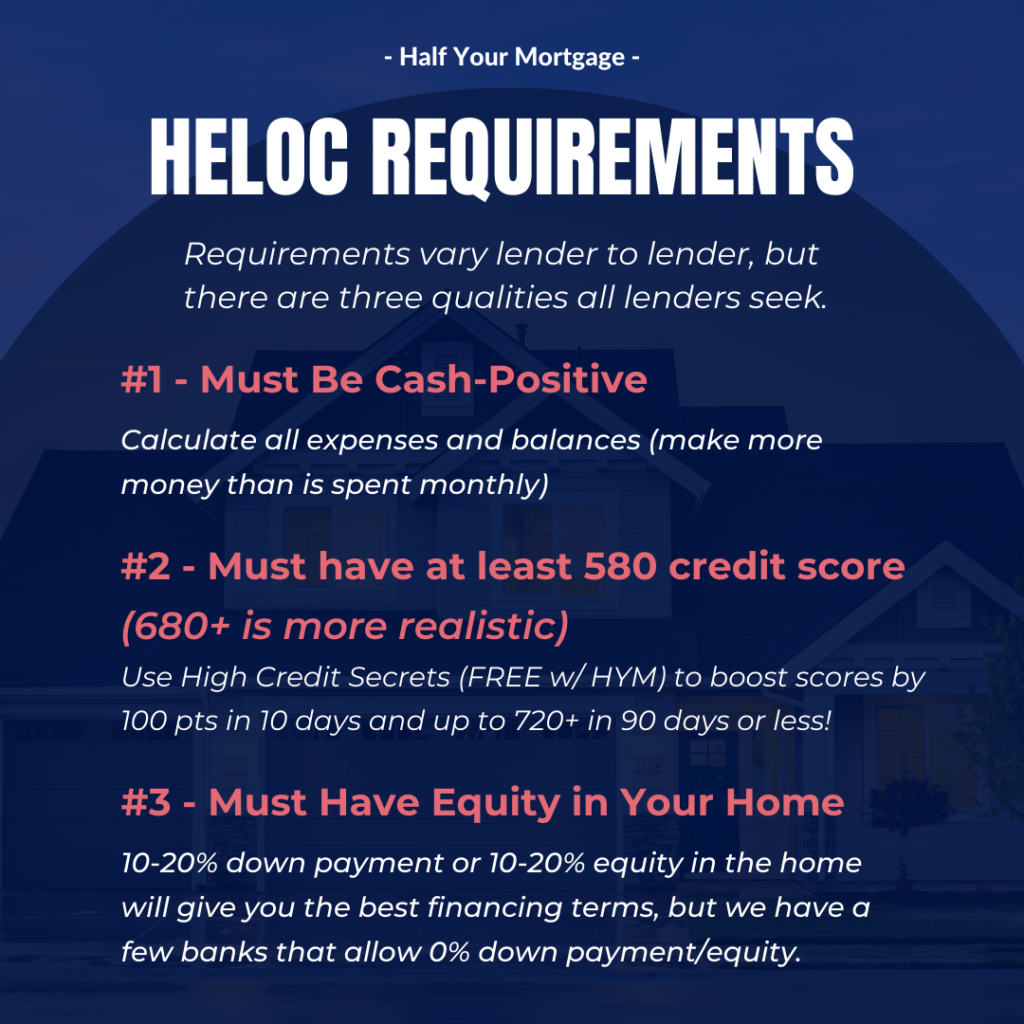

HELOC REQUIREMENTS:

1. Must have at least 10-20% equity in the home

2. Must have a 680+ credit score. If you don’t, use High Credit Secrets (comes FREE w/ Half Your Mortgage program) to boost it to 100+ in less than 30 days!

3. Must be cash positive. Calculate all expenses and balances (make more money than is spent monthly) DTI (debt to income ratio no higher than 43%). *The HYM program will also help you lower your DTI overnight!

The first requirement is home equity.

Having the option to borrow money against the equity you’ve built in your home is a major perk. Equity means leverage and we could all stand to use a little more of that these days.

Exactly how much equity do you need to take out a HELOC?

Requirements for both HELOCs and home equity loans are usually about the same. Most lenders require that homeowners have between 10%-20% equity in their home.

Equity is the difference between how much you owe on your mortgage and the home’s market value.

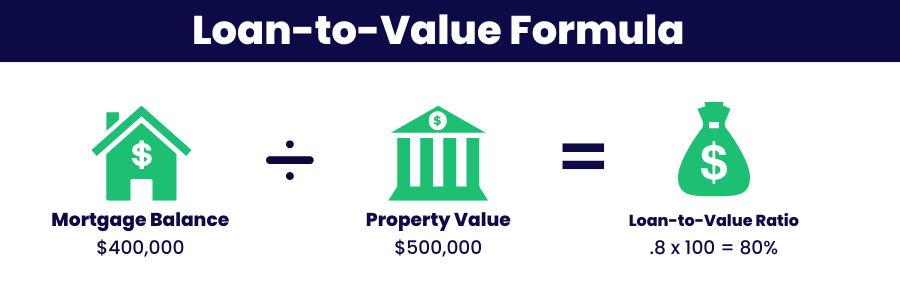

Your current percentage of equity will be used to calculate the loan-to-value (LTV) ratio. However, this ratio is an important factor to lenders in determining how much to loan you. To calculate your LTV, divide your current mortgage balance by the appraised value of your home. This will also determine your credit limit.

Mortgage Balance / Appraised Value of Home = LTV

Most lenders allow you to borrow up to 85% of the value of the property. This means the sum of your mortgage and your desired home equity loan can make up no more than 85 percent of your home’s value.

*Although some offer HELOCs up to 100%, typically the higher the lender’s LTV % – the lower the dollar limit. Meaning, you’re more likely to get approved for a higher loan limit with a 80-90% LTV compared to 100%.

►Boost Your Credit Score – A good credit score is important to receive the best terms. The lower your credit score, the more likely lenders may require you to have more equity.

Homeowners with credit scores as low as 620 can still qualify for a HELOC, but you will receive the best rates with 700+. (Even if you have poor credit, we can help you get up to 720+ in 90 days or less.)

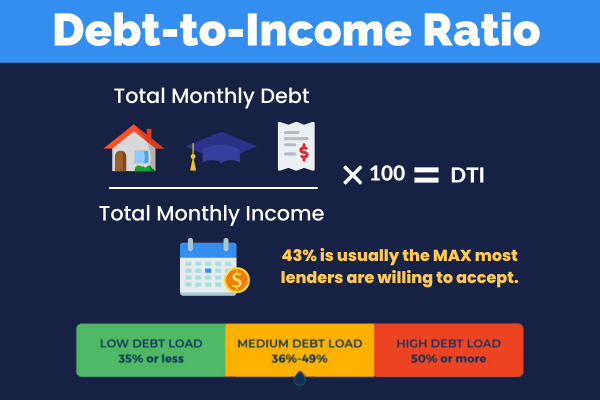

►Reduce Your Debt-to-Income Ratio – Ideally, you want your DTI percentage as low as possible. What ratios are considered qualifying will vary from lender to lender, but most lenders will accept a DTI up to 43%. To calculate your DTI ratio, divide your debt total by your gross monthly income.

Total Debt / Monthly Income = DTI

However, if you’re not at the optimum ratio the lender is looking for, you can reduce your DTI by paying down some existing debts.

Reducing the amount of debt will always help and a quick tip is to pay off the higher-interest debt first.

►Income – Your income is one of the first things the bank will look at. Having a higher income will also improve your DTI ratio, so any improvements you can make prior to applying for your HELOC, the better. Increasing your income can range from taking on more hours, increasing market efforts or also implementing a source of side income.

►Payment Experiences – Lenders will evaluate your credit history to analyze your risk of default by taking a closer look at your payment history. They want to know how trustworthy you are. You may be categorized as a high-risk borrower and receive less desirable terms.

►Cancel Private Mortgage Insurance – Private mortgage insurance (PMI) is what the lender charges you, to protect its investment if you don’t pay back your loan. PMI typically costs about 0.1% – 2% of your loan balance each year. The amount is broken into monthly payments that are added to your monthly mortgage payment. This adds more to your monthly payment and keeps you from building equity faster.

To get rid of PMI, you’ll need to have at least 20% equity in the home.

Once you do, you can contact your lender and request your PMI be removed. Once you have 22% equity in the home, your PMI will come off automatically. When you get rid of PMI, you can apply that extra money you’re currently paying to the principal balance of the loan and build more equity faster.

If you’re in a tight financial situation these last two tips may not be right for you but if you’re looking for every possible way to increase your equity before applying for a HELOC – these can help.

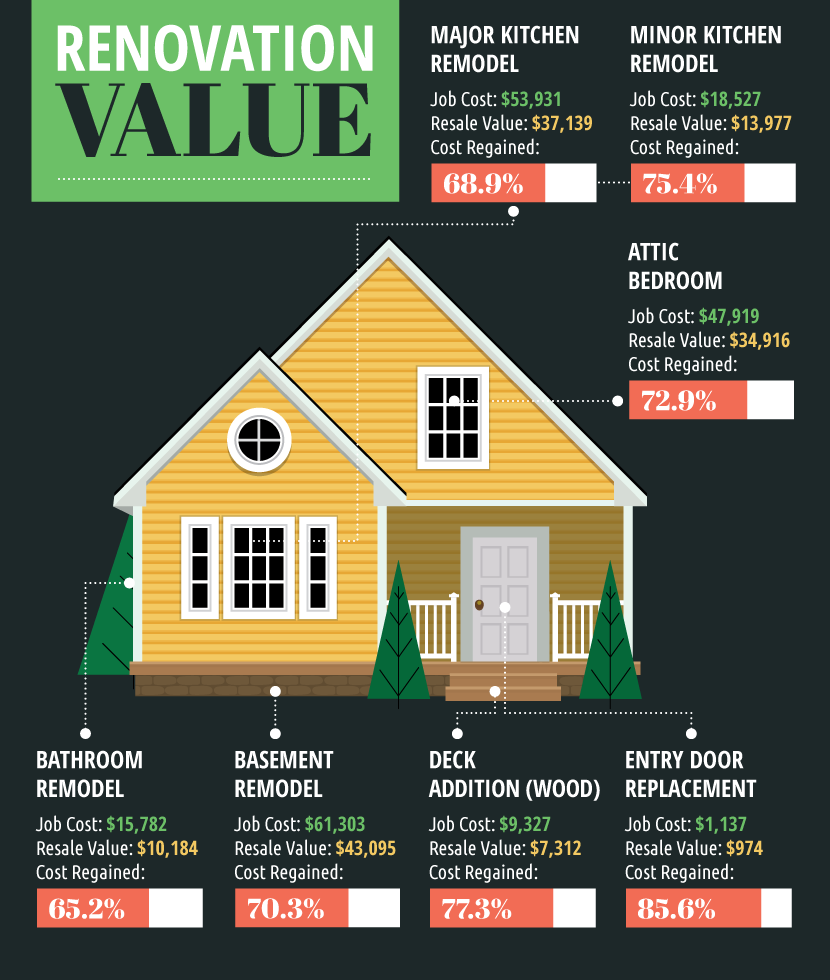

►Update Your Home – Making the right renovations to your home will increase its value. Bathroom, as well as kitchen updates are high on the list of things that add value to a home. Energy-efficiency updates can also increase the value of your home. Not all home improvements have to be big ones. Adding a fresh coat of paint or increasing curb appeal can go a long way, too.

Home improvements and remodeling also come with an added tax benefit since you can deduct interest for improvements or home renovations.

If you’re looking for a quick way to improve your cash flow using the equity you’ve built in your home…

A home equity line of credit is a wise choice.

We’ll show you the features your HELOC needs to have in order to save the maximum amount of money, how to calculate (and lower) your DTI, how to compare lenders, and also teach you our proven strategy to help you pay it off in less than 10 years (before the draw period ends – saving you THOUSANDS in interest!)

The exit strategy is half the battle when it comes to using a HELOC effectively and significantly reducing your interest costs!

In fact, our goal is to help you pay off your loan as fast as possible (in as little as 3 years) using our proven HELOC Hyperdrive Strategy.

Click the link below for a reliable way to pay off your HELOC loan FAST:

Learn More About the Half Your Mortgage Program

Our team can help you find out if your a good candidate for a HELOC before you meet with a lender or go through the application process…

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.