Wondering how long you can withdraw funds from your HELOC?

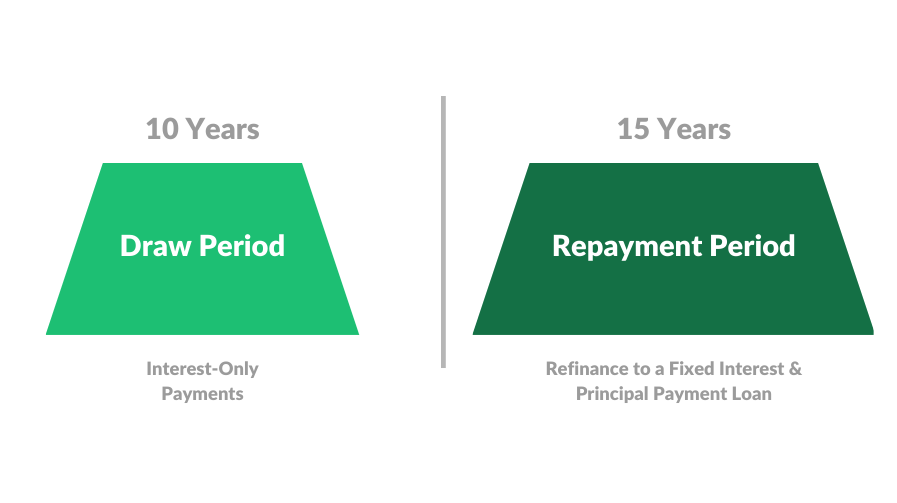

Unlike other types of home loans, HELOCs are unique because they work in two phases. A draw period and a repayment period.

Unlike conventional mortgages where you’re locked-in for 30-40 years or other options like personal loans that offer short terms for only 1 to 5 years…

HELOC draw periods generally last 10-15 years!

That means 10-15 years to withdraw your equity & use it like cash for whatever you need – whenever you need it.

Once you’re approved, you can spend up to your credit limit (by using special checks or a card to draw on your line.) Pay the balance down & repeat.

Typically you aren’t required to borrow a minimum amount each time, (except in a few states like Texas.)

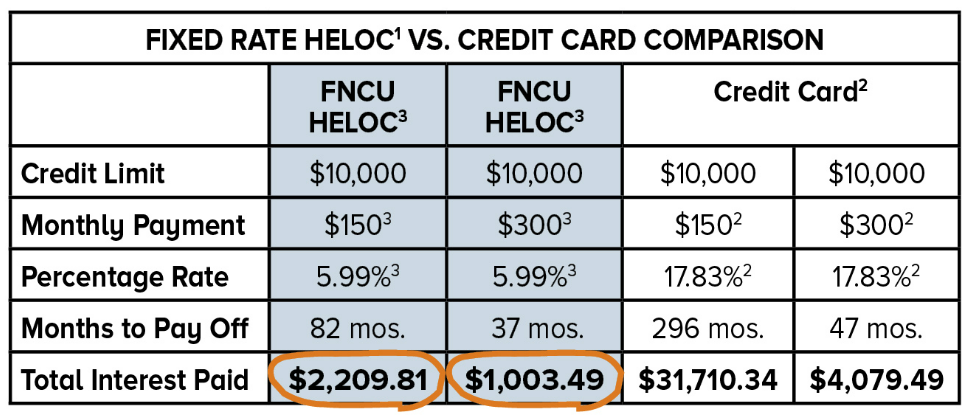

It’s like having a credit card with the best terms (and rates) imaginable!

Payments During the Draw Period

Some plans set a minimum monthly payment that includes a portion of the principal (the amount you borrow) plus accrued interest that you pay during the draw period.

The portion of your payment that goes towards the principal typically does not repay the full amount by the end of the draw period. Many plans allow interest-only payments (during the draw period) which means that you aren’t required to pay toward the principal. However…

We highly recommend you DO pay a portion of the principal. Do this during the draw period. So you can pay off your HELOC faster and reduce your monthly payments over time.

Don’t worry – we’ll show you exactly how to do this. If you follow our steps in the Half Your Mortgage program, you’ll be able to pay off the HELOC loan (in 10 years or less). BEFORE the official repayment period begins!

Once the draw period expires, you can no longer withdraw HELOC funds. Then the repayment period begins (we’ll go into more detail about that in tomorrow’s email.) Until then…

Listen to Steven’s experience using the Half Your Mortgage program…

We have SO MUCH MORE to teach you about finding the perfect HELOC

click to learn more about the Half Your Mortgage program.

We’ll show you how to… prepare your finances, boost your credit score,

lowering your debt-to-income ratio, ensure you get all the right criteria your HELOC needs (to save the MAXIUM amount of money), compare lenders, the questions to ask to ensure you’re getting the best deal and much more!

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.