Have you ever tried building business credit before?

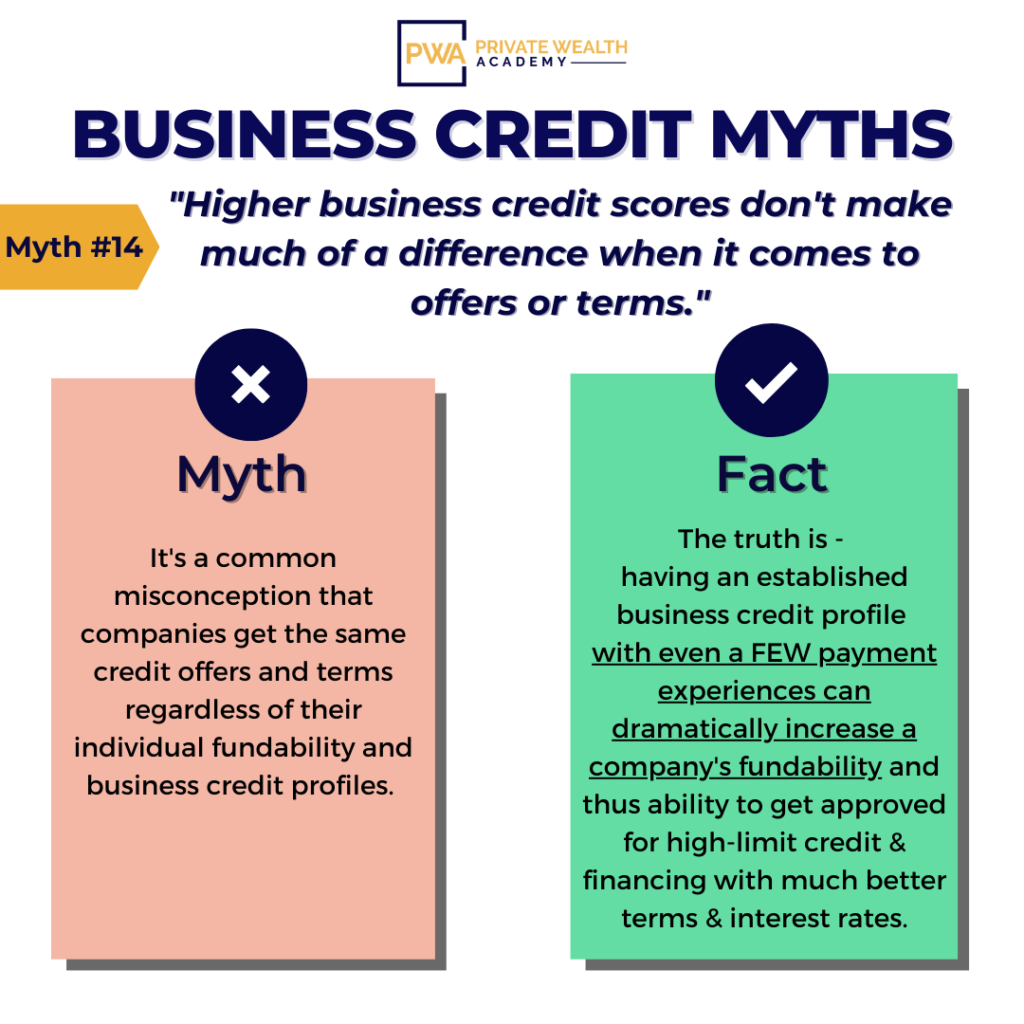

Did you find that the higher your business credit scores, the better the offers and rates?

If so, how long until lenders began approving you for $30K, $40K, $50K+?

2 years? 3 years? 5 or longer?

We’ve had students that had previously tried to build business credit on their own and it’s often taken them 3+ years to become fundable…

So it’s understandable how myths (like it takes 2 to 5 years to build good business credit) take root. We can see how you might think that too…

After all, it takes between 3-6 years on average to build strong personal credit. So why wouldn’t it take equally long to establish strong business credit, right?

But the truth is, it doesn’t have to take that long to get good business credit scores.

It doesn’t take as long to get business credit scores as you think.

You might even be avoiding the process of building business credit right now because you’re under the impression that it can take years to pull it off.

If you’re considering relying on your personal credit as the primary tool to fund your business needs, our advice is that you shouldn’t.

We know it may seem like the easier option and we see many entrepreneurs unwittingly use personal funds to run their business during startup phases but…

…doing so could have serious legal repercussions and in some cases may lead to ‘commingling of funds’ which would allow creditors or courts to ‘pierce the corporate veil’ if they ever suspect alleged fraud.

*There is a decent chance of this happening in the event you’ve been commingling funds or are severely undercapitalized and find yourself in bankruptcy court. But what’s even more likely to happen is that you’ll…

Soon max out your personal credit – leaving you with little to no credit to use for your personal needs.

You’ve worked long and hard to build a business and your personal credit.

Don’t risk it all…

You can establish business credit scores quickly – as long as you have a proven roadmap to follow…

The reality is that you don’t have to spend YEARS to get good business credit scores. With the right guidance, you can significantly expedite the process.

With our proven method, even brand new startups can quickly establish good business credit scores & be HIGHLY fundable in just 90 to 120 days!

What this means is that you can go from a wait time of two years to funding approvals in a matter of months (or even WEEKS!)

And, that’s not even the best part…

You’ll be able to get access to MUCH LARGER amounts of credit, (like hundreds of thousands of dollars) making it a lot easier to meet your business goals — whatever they are.

Imagine what that would allow you to do…

Even if you have bad personal credit, we’ll show you a few ways inside the program to quickly boost up your personal credit too.

If you want to learn how to secure $50,000-100,000+ in credit for your company within 6 months or less… (If you’ve been in business for 12 months or more, this process will be MUCH FASTER!)

Join The Corporate Credit Secrets Program

Still not convinced you can accomplish much as a startup?

Kristen Marie – Solo Esthetician, Entrepreneur

When she was just starting out as an Esthetician, Kristen wanted to venture out and start her own solo business. She had a little bit of money saved up for a down payment on a Salon Suite lease but still needed access to more funding to make it work. Kristen recommends talking with a loan officer about your situation before you start applying for anything. She started out looking at local credit unions (since they tend to have better loan terms & lower interest rates) but an SBA loan turned out to work out better for her situation. Almost one year later Kristen is expanding her business and has secured another lease on a second treatment room (next door to her first one).

Even if you’re brand new in your career – business credit can be the tool to help you quickly grow the the next level!

Learn More About Corporate Credit Secrets

Wondering if you can remove items from your company’s credit report? We’ll be talking about this and so much more in another post – so keep an eye out!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.