Have you been following all our posts regarding the most common business credit myth(s)?

What was the last business credit offer you got denied for?

We know how defeating that denial letter can feel…

There’s nothing worse than hearing “no” when you need access to funding.

Especially considering it costs $30,000-40,000 per year to run the average business…

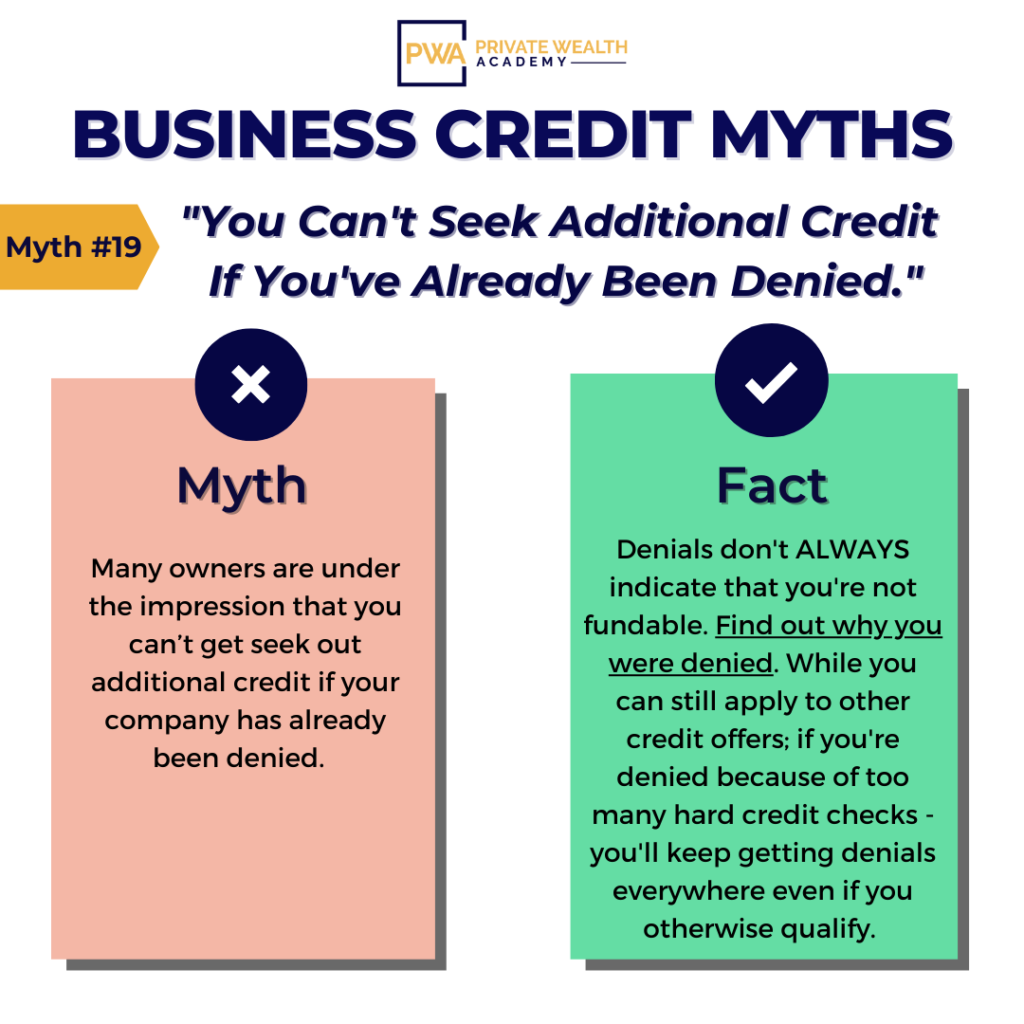

And unfortunately due to common business credit myths, some owners believe that if they’ve been denied it means they aren’t eligible for funding…

Hopefully by now, you can see how as a business owner you can MAX out your personal credit very quickly!

If you don’t have access to enough money, it can really put a damper on your business goals. In many cases, it could even mean the end for your venture.

Cash flow problems are common for businesses of any size. A few late invoices and less revenue than expected and you could be in deep financial trouble.

And you may feel like you have no way out.

But it doesn’t have to be that way…

A denial isn’t fun, but it doesn’t necessarily mean you’re not fundable.

Even multiple denials.

Just because you’ve had a few denials doesn’t mean other lenders won’t offer your business funding – so don’t fall prey to the many business credit myths floating around out there. You just have to know what to look for…

Denials can happen for a number of reasons – including inaccurate or inconsistent information.

Remember most initial approval or denial decisions are made solely by A.I.

So if information across all databases does match up exactly – BAM – Denial!

As we’ve talked a lot about over the last few days – payment history is also especially important to lenders.

In fact, even a business credit profile with a single credit line, can take your applications from denial to approval almost overnight.

Even just ONE payment experience on your business credit profile can make all the difference!

It’s not good enough to just cross your fingers and hope you get approved for business funding.

Lenders won’t take a chance on a business with no provable credit history. You’ll get denials every time.

Instead, you need to understand what lenders are looking for and build up a solid business credit history that proves you’re a fundable business worthy of their money.

The trick here is, though, that you have to follow the right plan in establishing business credit.

Once you get your first few initial credit lines, it becomes much easier to get approved for larger and larger accounts.

As you get more accounts on your profile, lenders will trust you, and your business credit will be established enough that you’ll get access to just about any type of funding you need.

Imagine what that could do for your business…

The money you need is available to you – you just need to know how to access it.

Wouldn’t you like a proven system guaranteed to help you get access to the credit you need?

That’s what we’re here to help you accomplish!

We know the proven steps to take, the right time to do them, and many other tricks of the trade that will save you time and money so you can establish business credit quickly (and correctly) and become a highly fundable.

There’s so much conflicting (and outdated) information about building business credit online…

Don’t go through the process of building credit alone.

Doing so just puts you at risk of more denials… more wasted time and more frustration. Instead, let us help you with our proven corporate credit building formula that we KNOW works well.

Ready to learn our repeatable method you can use to access $50,000-100,000+ in credit for your company in 6 months or less?

Join Corporate Credit Secrets Today

Check out our other posts on business credit myths so you learn and make your decision based on the FACTS.

And if you have any questions regarding Corporate Credit Secrets that we haven’t answered – contact us at [email protected]

We’re here to help!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.