Have you ever wondered what transactions affect your business’ credit scores?

Many people believe that only large transactions like loans show up and affect a business’ credit scores.

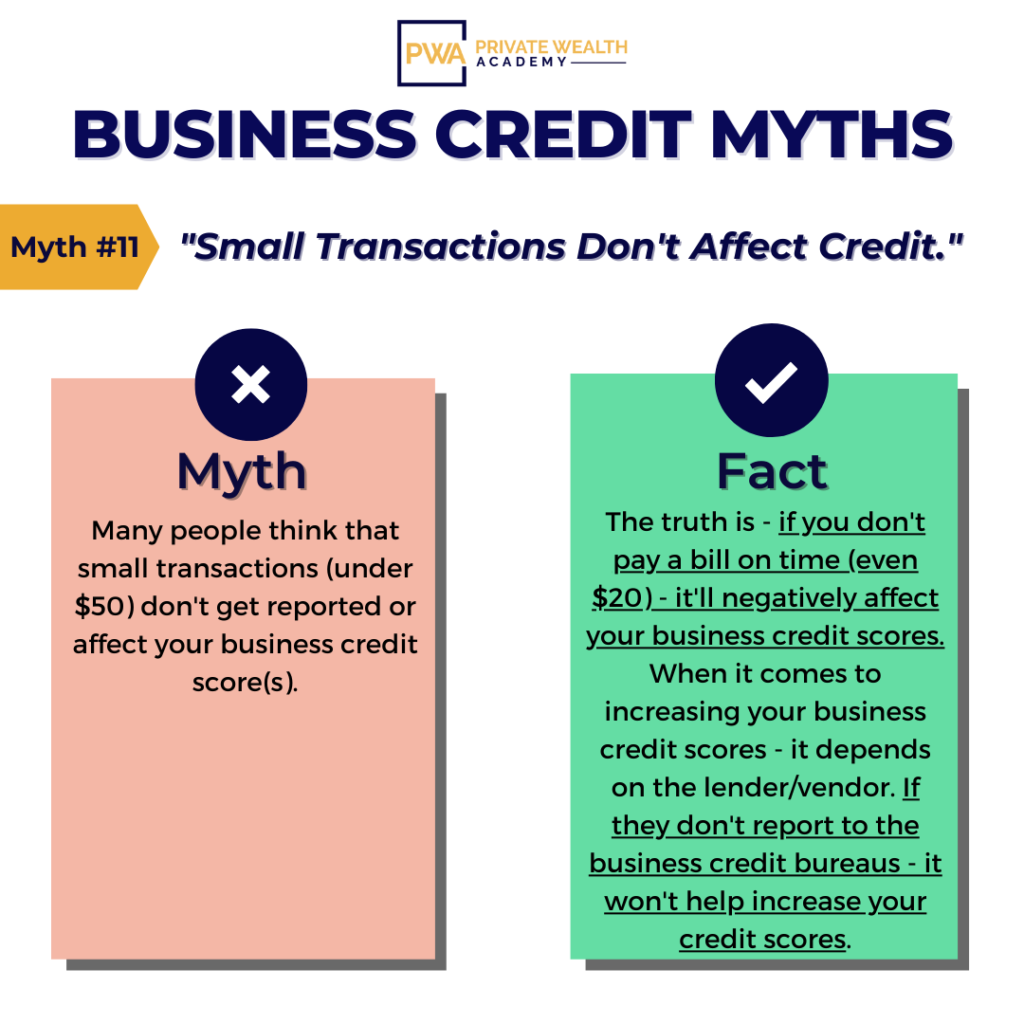

Others believe that small transactions don’t get reported or affect your business credit scores at all.

Tips About Business Credit Scores

A business’ credit scores are just a reflection of the information that has been reported by the commercial credit bureaus. The overall credit profile is a record of your company’s history managing payments and credit. This includes utilities, loans, lines of credit, credit cards, and vendor accounts.

It may also contain other information. This may include the year your company was established, how many employees you have, company industry, annual business revenue or registration details.

Each credit bureau has it’s own business credit scores and unique algorithm for determining them.

It’s easier to damage your credit report than it is to build it. This is because EVERY late or missed payment gets reported to all the credit bureaus automatically.

But, they DON’T always report every payment experience(automatically).

Sometimes lenders don’t report to the bureaus at all. Other times you just need to contact them and ask them to report it.

When it comes to large and small transactions –

It’s common to assume that large transactions, like loans, new business credit cards and hard inquiries affect your business credit report…

…but smaller transactions like small purchases, lease agreements, advertising accounts & insurance policy changes can also affect scores too.

While large transactions DO carry more weight…

Missing a payment is the worst thing you can do to damage your business’ credit scores (weather the balance is big or small).

The good news is, credit inquiries don’t affect your business credit as much as they do in consumer credit – unless the lender is checking your personal credit as well.

This is why it’s a good idea to check your business credit reports at least once a quarter.

It’s important because anything that’s not reported or added to your credit reports – won’t help to build your credit history…

The bottom line is: check your business credit scores and reports regularly so you know what’s being reported and what isn’t so you can make updates when they’re needed.

Be proactive with Corporate Credit Secrets!

You’ll learn how to establish & maintain excellent corporate credit.

Reducing the time it takes to get approved for high limit credit.

If you want to learn how to become a highly fundable company quickly and get access to $100,000+ in credit in 6 months or less…

Learn More About Corporate Credit Secrets

Remember, less than 10% of all vendors & lenders report payment experiences to the business credit bureaus.

This is the BIGGEST reason why it takes the right knowledge to build high-limit business credit in months instead of years.

Luckily, we have a team-member on staff whose sole-job is to make sure our reporting vendor-list is up-to-date so you can build up your corporate credit profiles as fast as possible.*We currently have 200+ vendors that actively report on our list – the most of any business credit-building program!

Ever wonder if carrying balance increases or decreases your company’s credit scores?

This is a common question that many owners mistakenly get wrong – lookout for our email tomorrow where we’ll be revealing the truth.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.