Interested in efficiently building your credit? Understanding the rules that lenders have regarding credit offers can be a game-changer.

For instance, did you know that Chase Bank allows you to acquire up to 5 credit cards within a 24-month period? This is known as the “5/24 Rule,” and it’s a crucial piece of information to have.

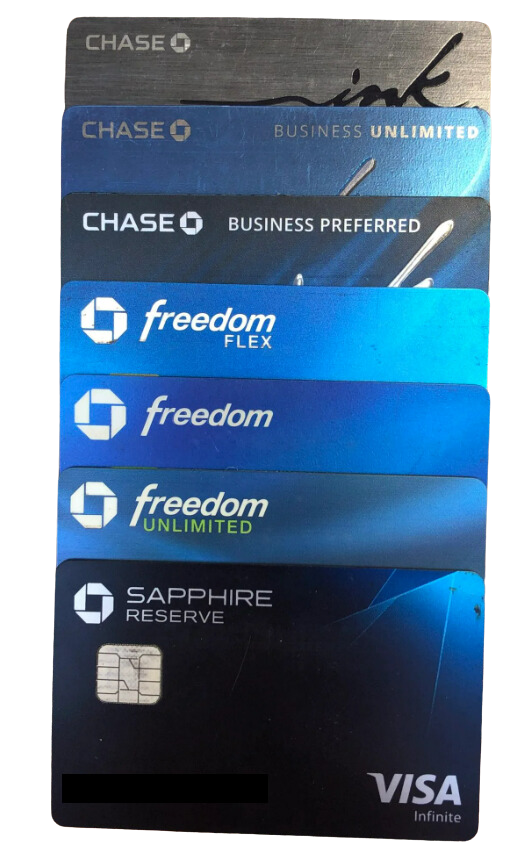

Chase isn’t the only bank with such a rule; it’s a common standard to consider when applying for credit cards. Chase, in particular, offers a diverse portfolio of credit cards. This is often regarded as some of the best in the industry. Notably, the 5/24 Rule doesn’t apply to credit cards issued for businesses.

Apply for Chase credit cards that align with your needs. The Chase Sapphire Reserve Card currently stands as one of Chase’s top credit card options. To increase your chances of approval with decent limits, aim for a credit score of at least 720. If you don’t qualify initially, check every 30 days to see if you meet the requirements for approval.

Build Credit Like a Pro

Like many of the best cards, Chase will want to see a credit score of at least 720 to get approved with decent limits. If you don’t immediately qualify, you should check in every 30 days to see if you are eligible.

Start by applying for the Chase Freedom Credit Card, use it frequently, pay off the balance in full each month, and wait for 3 months. Return to Chase Bank on day 91 and check if you’re pre-qualified for the Sapphire Reserve Card.

If you encounter difficulties obtaining more credit cards, consider opening a bank account with Chase, deposit at least the minimum required amount, and let it sit for a minimum of 120 days before applying for additional credit. This establishes a favorable bank rating. Optionally, you can turn it into a trust account, placing you in the “high-profile customer” category. This will enable you to apply for the Chase Ink Preferred Business Credit Card.

Quality cards, not quantity, contribute to a higher credit score. Make the most of the cards offered by Chase.

On average, a consumer will take 5 years to build their credit from a “thin profile” to an 800 Beacon Score. But don’t worry with the help of High Credit Secrets you’ll be able to get there in a matter of a few short weeks. Here, you can find everything a person must do to get a solid credit history from the get-go. Faster progress is possible thanks to the techniques revealed in this program.

Learn The Secret

If you give yourself just a few months to fully implement the strategies inside High Credit Secrets, and you’ll be able to climb to the highest possible credit tier and the best part is that you only need to devote a few minutes per week to accomplish this goal. Incorporate this course into your life and find true financial value at your fingertips.

Keep an eye out for tomorrow’s post, as we reveal the best-kept secret that makes a huge impact on your credit score in just 30 days.

Learn More About High Credit Secrets

Consider American Express as well, as only your first credit card application counts as a HARD inquiry. Subsequent applications are considered soft inquiries and won’t affect your number of inquiries or credit score.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.