Wondering How to Improve Credit Score Fast?

When it comes to securing the best credit cards, a minimum credit score of 720 is often required. Don’t despair if you currently can’t get the credit cards you desire; you do have other options.

How to Improve Credit Score Fast: Step 1

To tackle this, consider opening a secured credit account. This is particularly beneficial for individuals with low credit scores or limited credit histories. With a secured credit card, you make an upfront payment ranging from $200 to $1000, effectively turning it into a debit card while it reports to your personal credit profile. The great news is that this step alone can boost your score by 50-100 points!

Secured credit cards are frequently the starting point for building credit. Notable institutions like Amazon and the Navy Federal Credit Union offer secured credit cards to their members.

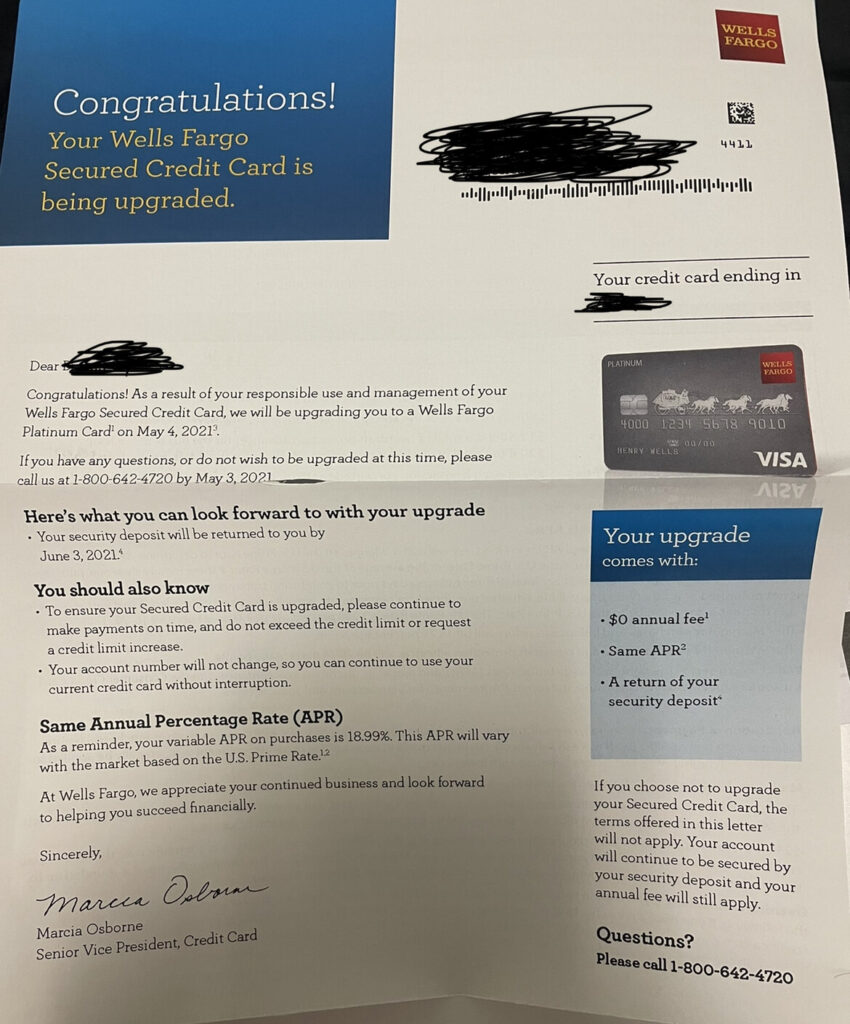

You can also acquire these cards by opening an account with prominent financial institutions like Bank of America or Wells Fargo. Discover offers a secured option called the Discover It Credit Card.

How to Improve Credit Score Fast: Step 2

Once you have made payments on your secured card for a few months and your credit score has reached 720 or higher, contact the banks immediately to convert these secured credit cards into unsecured credit cards.

Your improved credit score should earn you a “YES” response from the majority of lenders, immediately elevating your scores across the board at the credit bureaus.

Did you know that 35% of your credit score is based on your payment history? This is why making on-time payments is so crucial to high scores.

Want our help learning how to improve credit score fast?

While we have made this program to accelerate the credit-building process as much as possible, it is key to remember that time is on your side in creating positive payment experiences and patience is required for success.

By following this course you’ll be able to improve your personal credit within a few months (or less).

Whether you want to qualify for a loan with a better interest rate, obtain the best credit card deals and rewards, or obtain better car and home insurance rates, all is within your reach with High Credit Secrets.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.