So you want to learn how to pay off your house in 7 years or less?

Is the whole HELOC puzzle starting to make more sense to you?

Hopefully so, but in case you’re still not quite sure how this all works, let’s quickly review it once more.

Every time you borrow money using your house as collateral, the lender places a lien on your property.

A traditional mortgage lien usually sits in the “first” position.

If you happen to refinance your home or get a home equity loan. Because it sits in “second lien” position behind the first loan. However…

A first-lien HELOC takes the place of a first mortgage making it the only loan and lien on your home. Make sense?

The Truth About “Fixed” Mortgage Rates

First mortgages often come with fixed interest rates and fixed principal and interest payments over the term of the loan.

So due to the fact that mortgage interest is calculated on the entire loan amount, you’re forced to pay off the interest first.

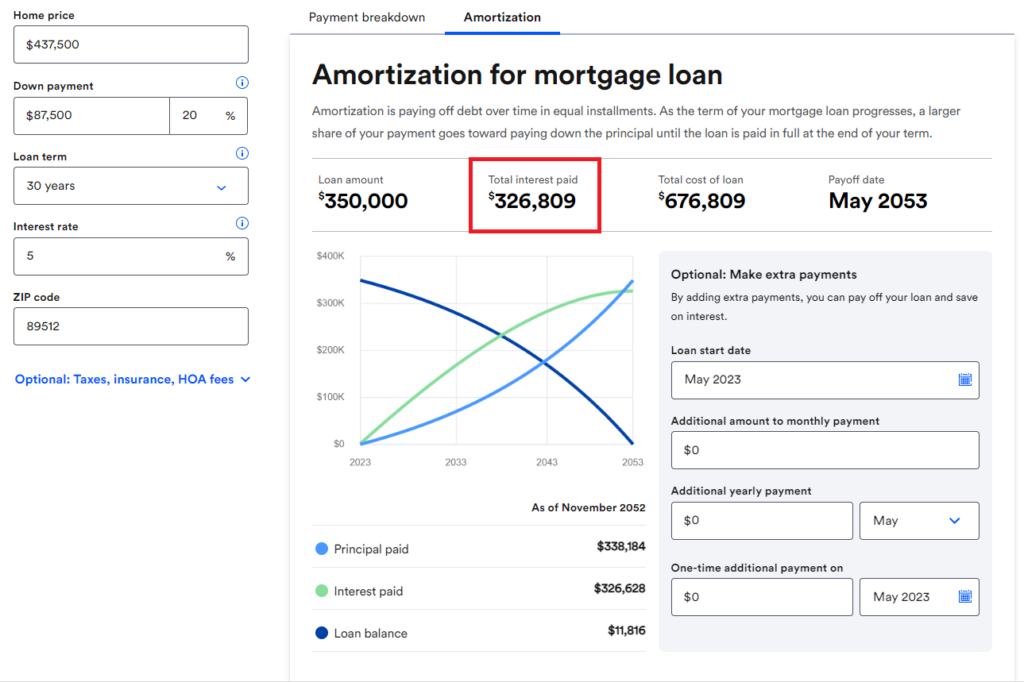

The total interest paid on a mortgage is typically as much as the original loan amount! For a $350,000 mortgage – that’s $326,809 you’re paying in just interest! Isn’t that insane?

Crazy how much you end up shelling out, right?

How a Home Equity Line of Credit Saves You TONS of Money

A HELOC on the other hand, operates as a revolving credit line (like a credit card) where you can withdraw money as needed, paying interest only on the amount you use calculated on the average daily balance.

So, by decreasing your balance, even at a daily level, your interest payment decreases overall. This makes a HUGE difference in how much interest you end up paying overall.

Making a First Lien HELOC the perfect blend of a traditional mortgage and a Home Equity loan.

You can use a First Lien HELOC to either replace your existing mortgage, to purchase your new home (or for a multitude of other things!)

This gives you all the benefits of having easy access to your equity and the convenience of managing a single loan.

This Strategy Shows You How to Pay Off Your House in 7 Years or Less

How Much More Can I Save Using a HELOC?

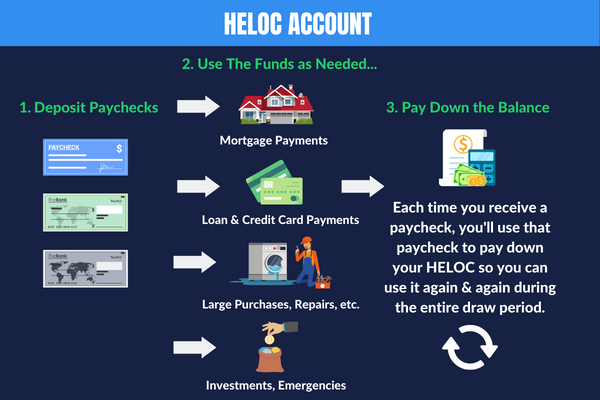

The first lien HELOC becomes a significant advantage when you route your income through it to pay down your line of credit.

By directing all of your income and expenses through your first lien HELOC, each payment you make reduces your principal balance, saving you TONS of money in interest.

Plus it offers the flexibility to pay down as much as you want without being penalized over the entire term of the loan.

To be clear, this isn’t saying that you’re spending ALL of your income on loan payments…

However, when you can put as much towards the principal as possible you’ll be able to save an INSANE AMOUNT IN INTEREST!

How much can you save?

Check it out…

When you compare these numbers, the difference paid in total interest is staggering. With a $350K mortgage you’d be paying $326,809 in interest ALONE! Or…

With a HELOC, you could lower the interest costs down to $75,161 for the same $350K loan. That’s means you’d be saving $251,648! WOW!

Of course, this amount of savings requires following our proven HELOC Hyperdrive Strategy as shown in the Half Your Mortgage program where you route all income and expenses through the first lien HELOC.

We know you may be worried about not putting money aside for saving or investing…

To be clear, we aren’t saying not to save or invest…

However, for the duration of the draw period, the HELOC will be used as your PRIMARY account since you can withdraw money any time.

If you want to have another savings account on the side – that’s fine too.

But by contributing all would-be savings to your principal, you end up saving $$,$$$ to $$$,$$$ in interest – much more than you would typically generate on investment returns.

In the example above – you’d be saving $251,648 in interest alone! And paying off the home in 7.8 years. That means…

You could buy a whole new property AND have…

22 LESS YEARS OF HOUSE PAYMENTS! That’s pretty amazing, right?

The goal is to pay off your HELOC loan within 5-7 years (maybe sooner.) After that, you’ll be in a prime position to significantly ramp up your savings & investment game.

Is it really THAT simple?

It really is.

Just think, in one-third of the time it would take to pay off a 30-year mortgage, you could be paying off your second or third property!

By routing your cashflow with your first lien HELOC as the hub for your income and expenses, you pay down your principal balance faster, and reduce the total interest you pay exponentially. As long as you bring in more than you spend each month, you’ll see significant savings!

Don’t worry – you don’t have to figure all this out by yourself…

The Half Your Mortgage program will help you save tens to hundreds of thousands of dollars over the course of the loan & maximize your cash-flow.

We’ll show you how to find the right first lien HELOC, teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to find the best HELOC lenders, how to lock-in the best rates and so MUCH MORE!

Click the link below for details on how you can shred your amortization schedule & put you on the fast track to paying off your home in 5-7 years:

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.