Have you been wondering how to use a HELOC correctly?

Are you secretly afraid of making a mistake while getting your HELOC?

It’s also okay to be cautious and ask questions. This is your home we’re talking about after all.

A home equity line of credit (HELOC) can help you get access to cash quickly and also easily. And who doesn’t need some extra cash on hand at times, right?

You can use the funds for emergency expenses or even to supplement income if you’ve been laid off, are retired or just need the extra funds. It’s also an excellent option for those that want access to additional liquidity during difficult financial times.

The HELOC is a prime example of how debt can be a powerful tool that works in your favor when used properly. However, there are several BIG mistakes that people can fall into when it comes to HELOCs.

Here are the most common ones to avoid…

1. Not Knowing the Difference Between 1st Lien & 2nd Lien HELOCs

Not all HELOCs are the same. There are major differences between first lien (1st position HELOCs) and second lien position. Whenever possible, you want to secure a first lien position HELOC.

This allows you to REPLACE your mortgage loan & avoid having to make payments on two loans. First lien HELOCs tend to come with lower rates and are also much more flexible in terms of repayment options.

2. Making Interest-Only Payments

Most HELOCs offer interest-only payments during the draw period. That is why the payments can be so small. However, the key to saving THOUSANDS in interest and paying off your home in the fastest time possible – is when you use the HELOC account just as you would use your primary checking account – using direct deposits and making all payments from that account. You can always withdraw money back out as you need it. This allows you to put the most amount of money towards the principal making it the quickest way to pay off your home. This is exactly what our HELOC Hyperdrive Strategy shows you how to do in detail.

Here, take a look…

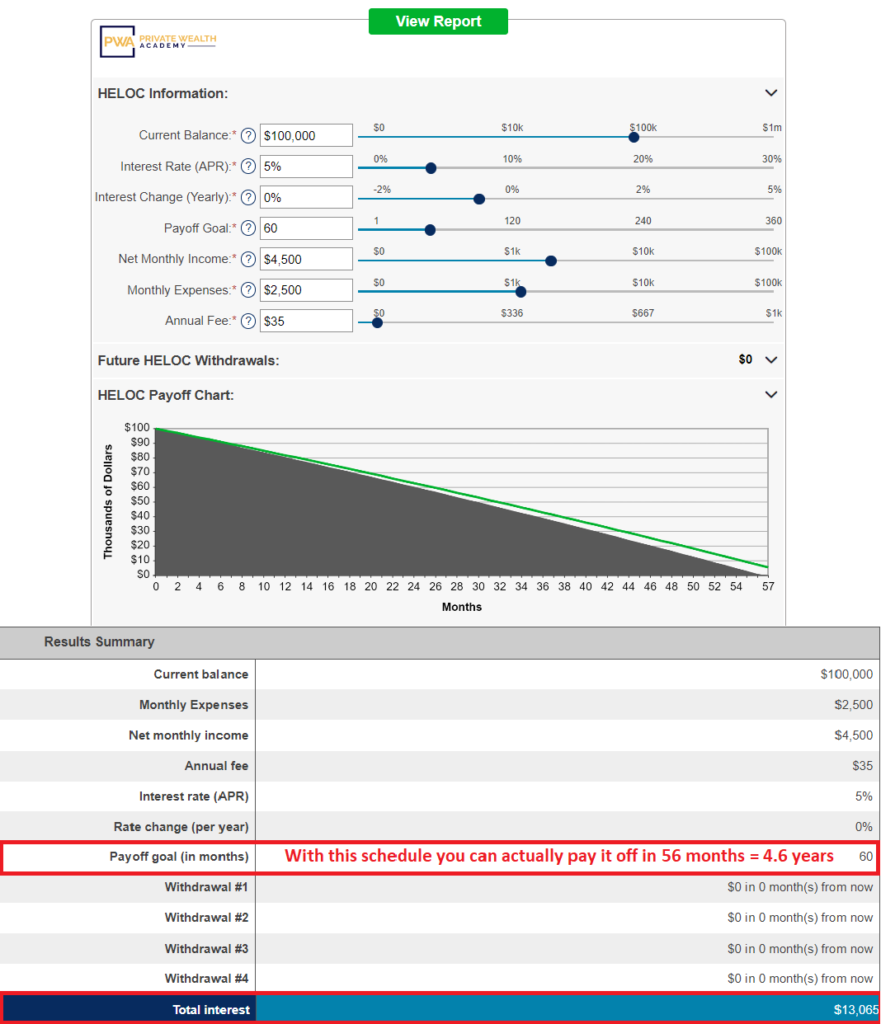

Making interest-only payments on a $100K HELOC with a 5% interest rate would take you 20 years to pay off and also have you paying $77,279.06 in interest alone. While that is less than a 30-year mortgage…

If you make principal + interest payments throughout the entire term you can pay off the loan in just 4.6 years and only pay $13,065 in interest. Giving you the ability to save $64,214.06 and 15 years of payments!

That’s a significant savings, wouldn’t you agree?

3. Not Shopping Around Enough

You may decide to take out the loan from the bank where you have a checking account, but that’s usually not the best fit. If you wish to get the BEST rates and terms for your needs, look for one that has the right criteria based on what we show inside the Half Your Mortgage program in order to secure the most affordable, manageable and least risky HELOC. Don’t get lazy. Shop around and get quotes from at least 4-5 lenders to see what else you can get before choosing the best one. *Being a student of the HYM program will help you shortcut this step.

4. Not Knowing What to Ask Lenders

The key to getting what you want starts with asking the right questions. There are a number of elements involved in a HELOC. So by knowing exactly what criteria to look for & questions to ask, you’ll be able to save time and better compare lenders allowing you to choose the best one that’s right for you. Don’t worry – we cover all the questions you should ask a prospective lender inside the Half Your Mortgage program.

5. Not Asking for a Good Faith Estimate (GFE)

It’s your lender’s responsibility to provide you with a Good Faith estimate (GFE) (i.e. Loan Estimate) after you apply. If they don’t – ask for one. A GFE provides you with a breakdown of all the fees involved so you can be assured that you will not be paying any hidden fees or costs. There shouldn’t be any surprises when you get your first billing statement.

6. Spending HELOC Funds Frivolously

While you can spend HELOC funds on anything – considering that the loan is secured by your home, these funds should be used wisely to help you further improve your financial situation and grow your wealth. We don’t recommend using a HELOC to purchase things you can’t afford or things that will quickly depreciate in value like a new car, vacations, a wedding, etc. Debt must be used properly for it to be beneficial.

We know this is a lot to grasp but you don’t have to go through this process alone…

That’s why we created the Half Your Mortgage program.

We’ll walk you through the steps of getting a first lien home equity line of credit. From calculating your borrowable equity to interest calculations, to finding the right lender, to locking in the best rates & terms – we’ll teach you everything you need to know to close on the perfect HELOC for you.

Isn’t it time you have a reliable way to meet your financial goals?

‘Half Your Mortgage’ shows the mathematically proven method to pay off your HELOC loan in 5-7 years using your current income!

The Half Your Mortgage program will help you save tens to hundreds of thousands of dollars over the course of the loan & maximize your cash-flow.

We’ll show you how to calculate your amount of borrowable equity, how to calculate your Debt to Income ratio, lower your DTI, what to do in the event you get denied for a HELOC, show you how to calculate interest, and more!

You’ll also get access to our custom HELOC calculators (to make the math super easy), a list of state-specific lenders, a bank questionnaire so

you can ensure you’re getting a HELOC with all the right criteria, and our

proven HELOC Hyperdrive Strategy will show you how to pay off the loan

in the as little as 3 years! Why wait?Click the link to get started TODAY!

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.