Are you on the journey of building corporate credit?

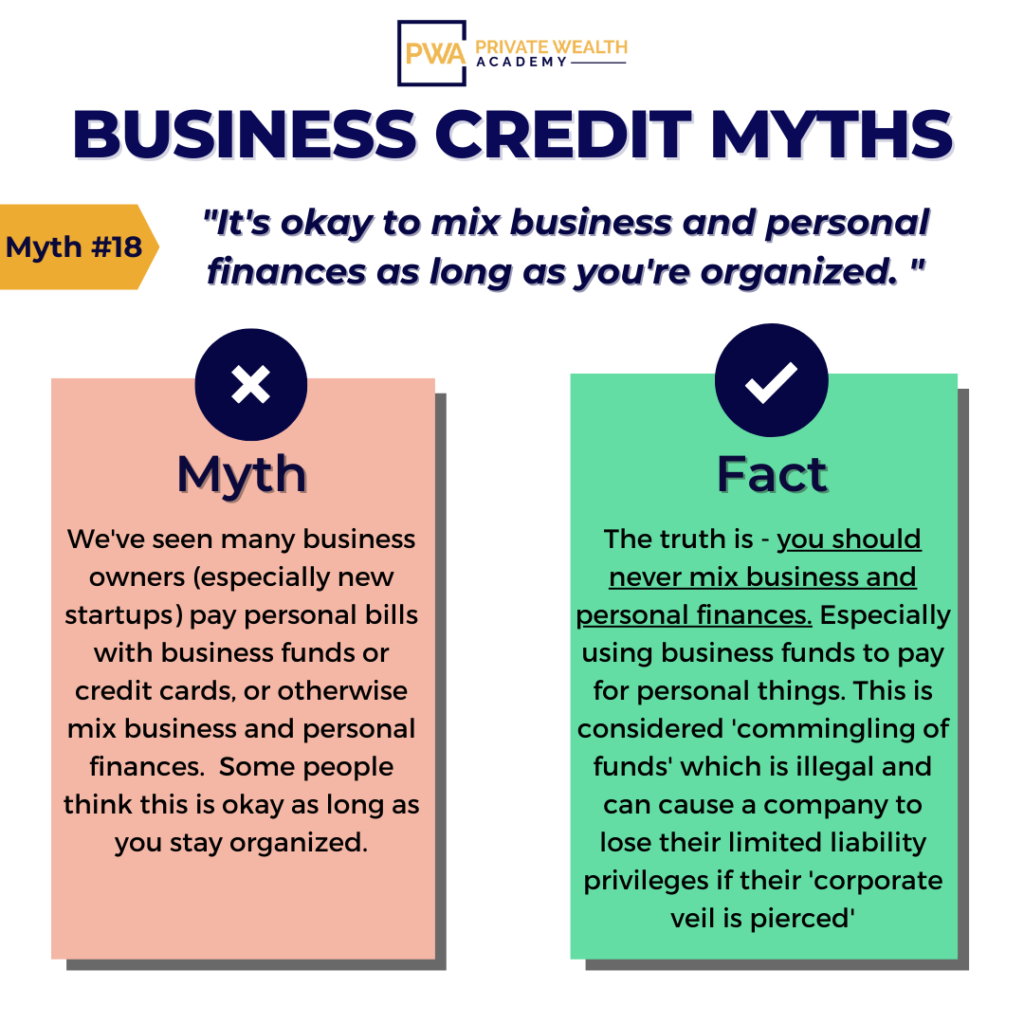

Have you ever mixed personal and business finances?

Ever paid a personal bill with your business account or credit card?

If so, you’re technically guilty of commingling funds which could be considered fraud. (Although no one is probably coming after you.)

We don’t say this to sound threatening or scary but to merely prove a point on how easy it is to lose your limited liability privileges (legally speaking).

If you ever heard someone say “it’s okay to mix business and personal finances” – STEER CLEAR! Regardless whether you’re building corporate credit or not, that is NOT a good financial practice.

Mixing your personal and business finances shouldn’t be the status quo.

And yet it’s one of the most common risky acts we see owners make…

If you want to maintain limited liability, have longevity, and staying power you MUST keep your finances separate when building corporate credit & beyond.

Doing anything other than that will put everything you have at serious risk.

So, how can you keep your personal and business finances separate?

Start by having a separate business bank account, debit card to pay business bills with and a business credit profile.

Establishing a business credit profile for your company will allow you to get the money you need and add a layer of separation between the business and your personal finances.

It also helps to reduce your personal liabilities when building corporate credit — which is incredibly useful for protecting your wealth.

Shareholders and officers of corporations and LLCs are not generally responsible for business debts. If the company goes bankrupt, its shareholders and officers typically are not personally liable for the debts. However…

There are a few ways you CAN be held personally liable for business debts…

Personal assets are legally considered completely separate from the company’s assets, as are the corporation’s assets protected from the officers and owners of the company if they go bankrupt personally.

BUT, if you commingled your finances, you risk it all with bankruptcy.

If creditors or courts suspect that your company is merely a ‘shell’ or ‘alter-ego’ of the owners, has commingled funds or has otherwise engaged in fraud – the courts can ‘pierce the corporate veil.’

This essentially removes your corporate privileges and makes you responsible for business debts in a personal capacity.

However, if you’ve maintained proper separation, if a customer, vendor, creditor, or anyone else who has interacted with your business tries to sue, your personal assets cannot be seized.

Separating personal and business finances isn’t just better for building corporate credit and legal purposes though…

It also makes the process of tracking business expenses easier, which is very important for tax purposes. It also makes it easier to raise capital and solicit investors when you’re ready.

How do you do this?

Separating finances and building corporate credit can be straight-forward and there are some tricks of the trade we can teach you that can help speed up the process. We can’t wait to help you get started!

Learn More About Corporate Credit Secrets

Inside the Course, You’ll Learn How To…

•Avoid personal liability and remove nearly all the financial risk that comes with running a business

•Become highly fundable QUICKLY so you can obtain all the funding you need for your business in a matter of MONTHS (or even WEEKS!)

•Learn a repeatable method you can use to get virtually unlimited credit for your company (most secure $50k-100k in 6 months or less.)

You don’t have to be a CPA or expert. PLUS, this method will work for you even if you have bad or no credit, are a brand-new startup or don’t even have a business yet.

Join The Corporate Credit Secrets Program

Worried you might not be able to get funding because you’ve been denied? We’ve got GOOD NEWS! Be sure to open up our post tomorrow!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.