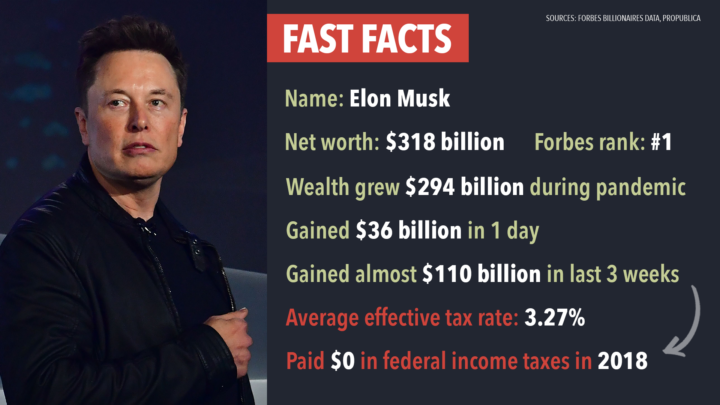

Have you ever looked into the finances of the ultra wealthy?

The wealthy use corporate tax credits, trust webs, charities, state churches, welfare organizations, foreign off-shore accounts and a variety of other complex tax shelters & loopholes to legally avoid paying income taxes.

These entities act as a “front” to receive free money and shift income from legitimate corporations to drastically cut their tax liability.

Despite The IRS offering more than 29 distinct kinds of tax exempt entities, the vast majority won’t help to reduce your tax liability. Unless you’re operating a faith-based or non-profit – none of these entities can guarantee they’ll reduce your income taxes…

Even worse, these organizations often give up their rights for the benefit of a tax-exemption license.

So, how does one obtain the coveted tax exempt status without succumbing to the government and losing all of their constitutionally protected rights?

We’re looking to be the tax exception – not seek tax-exemption. That’s key!

Tax Exemption vs Exception

An exemption always requires one to ‘register’ or ‘apply’ for a license.

‘Exemptions’ require you to get permission from an agency or State.

We want to become the exception to owing taxes – not become exempt.

We want to avoid the obligation of income taxes in the first place…

Being the exception means you’re in a reserved class of individuals held to different standards and rules than the rest of the populus.

This is where MANY go wrong with taxes. Many think they can either…

simply stop paying taxes (evasion) OR attempt to claim a tax exemption that doesn’t apply to them (fraud) OR don’t understand the tax code and seek to make up their own “loopholes” (frivolous arguments).

There ARE legal remedies to remove your income tax liability but one must understand the law and take action. If you want proven remedies to remove your tax liability, get Elite Tax Secrets.

You don’t have to take us at our word…

The Elite Tax Secrets program provides all of the Supreme Court case law you could ever want to back you up.

Just A Few Benefits of The Elite Tax Secrets Program:

- Discover the easiest, fastest way to legally remove your income tax liability that any person, business, trust or organization can use.

- We’ll show you how to keep up to 100% of your money at tax time.

- No complicated tax shelters, off-shore accounts or corporate loopholes.

- Operate a welfare or faith-based organization without State control.

- Learn 3 methods to remove tax liability for welfare or faith-based organizations.

If you’ve held off on reducing your taxes because you’re worried that…

The strategies will be too complicated…

The methods will take too long to implement…

Or that it will cost too much money…

Then be sure to keep an eye out for our next few blog posts because we’re going to show you how you can easily (and legally) keep up to 100% of tax money for life without having to set up complex tax shelters, foreign accounts or pay a fortune in the process.

In tomorrow’s post we’ll be dropping a HUGE TRUTH BOMB about taxes that will absolutely shock you.

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.