How’s Your Journey of Building Business Credit Going So Far?

What happened the first time you applied for a credit card or loan that was “out of your credit league”?

You’ve may hit the submit button, only to end up with the dreaded 7-30 day message that puts you in limbo about whether or not you were approved.

Or, even worse, you may have gotten an instant denial.

There’s nothing worse than seeing ‘we cannot approve you‘ on the screen.

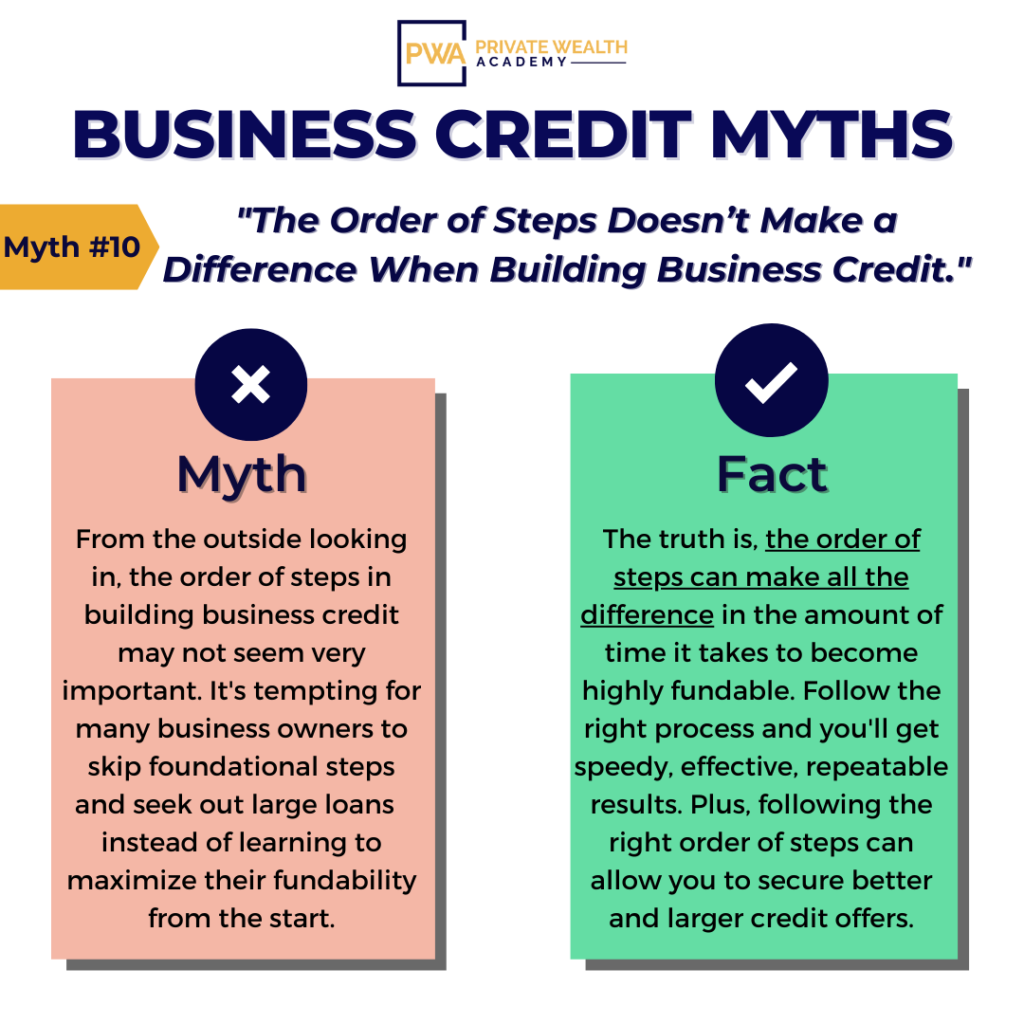

Lots of people learn their lessons the hard way about applying for the right credit products at the right time. And, it’s no different for business owners.

One Thing to Avoid When Building Business Credit…

On their journey of building business credit… lots of entrepreneurs will find a credit offer that sounds great…

But instead of doing their due diligence – they’ll just immediately apply for it.

That’s a great way to extend how much time it will take building business credit.

If you jump the gun and apply for offers you don’t qualify for — it’s going to turn out just like that ‘out of league’ application did…

In other words, you’ll end up with the same big, fat DENIAL.

For the most approvals and highest limits, you need to follow steps in a certain order when building business credit…

Remember, you only get so many hard credit checks (usually only 5 every 24 months.) Considering each inquiry can be worth $20,000+ applying for credit you won’t be approved for is a waste of hard inquiries.

If you don’t have a solid credit profile but you apply for business credit cards like Visa, Mastercard, bank cards, or other cards, you’ll often find you’re going to get denied and waste hard inquiries.

Building business credit to form a strong credit profile and payment history so that your corporate credit can standalone is the best way to go.

‘Standalone’ means is that your company, will be approved for credit using just your business credit information and EIN.

Yes, consistent revenue will help approvals greatly, but if you’re a startup or have little to no revenue coming in yet – or want standalone credit…

Building business credit in the right steps – is VITAL and will save you time

This means applying only for specific credit products at first – that you can obtain during the early phases of establishing your business credit profile.

It’s common to want to skip over those initial steps for building credit, but it’s vital for establishing a solid credit foundation.

You have to start with the accounts you can actually get approved for — the ones with the least amount of restrictions and documentation.

Do this right and it will lead to you getting approved for other types of credit.

Skip this and it will only increase the time it takes for your company to become fundable.

Before you take that leap, though, remember…

The #1 thing to keep in mind when building business credit is that…

Not all credit accounts will report to the business credit bureaus.

The idea that all business credit accounts report to credit bureaus is another common myth, one that MANY entrepreneurs get wrong. (This is the #1 reason why it takes people 2-5 years to do this on their own.)

This is a very COSTLY mistake to make – both in time and money.

In fact, less than 10% of all creditors report to business credit bureaus.

Only issuers that report to these credit bureaus will help build your company’s credit profile.

our course short-cuts the time spent building business credit

So, how can you determine which lenders to target first?

We can help! In our Corporate Credit Secrets program, we’ll tell you who those issuers are and how often they report.

In fact, we have over 200 active vendors that report to the business credit bureaus that WILL help you build up your company’s credit profile.

If you’re serious about building business credit and want a proven system to help you get approved for $50,000-100,000 in 6 months or less…

Join The Corporate Credit Secrets Program

Curious how much certain transactions affect your company’s credit scores? We’ll reveal this and more in tomorrow’s email.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.