Looking for a mortgage alternative?

Before we get into that, do you remember how Carlton’s wealthy clients invited to him to banquet? And how one of the bankers showed him the napkin math proving all mortgages are scams?

As the banker scribbled down notes, he went on to ask Carlton…

“Weiss, you’re a bright man – have you ever read a Loan Estimate [Truth-in-Lending] disclosure? You’re basically buying a home for yourself and another one for me [the bank]!” The banker said laughing almost maniacally as he poured another glass of wine.

“Haven’t you ever wondered why you can make mortgage payments for 5 years straight (or more) while barely putting a dent in the principal? We’ve designed it like that on purpose.” The banker proudly admitted.

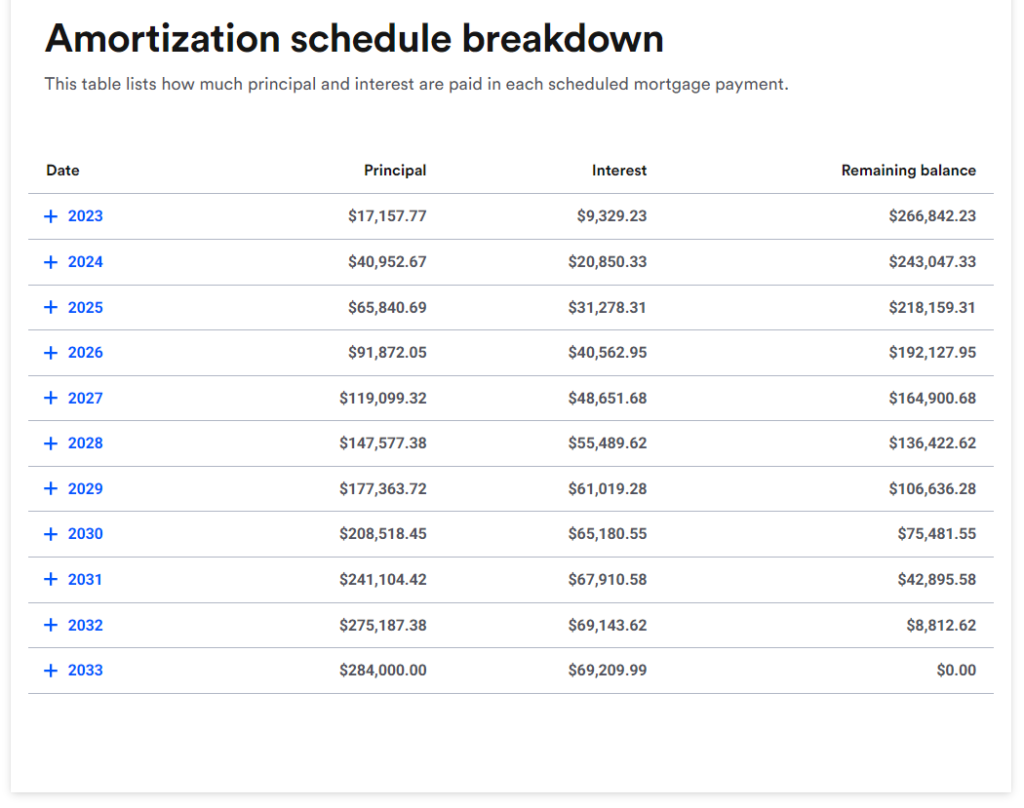

Carlton fell silent as the banker showed him this fact.

And you wonder why they change up the “right way” to do math every generation… Without knowing how to do math correctly, you can easily be a slave for life without realizing it! (Are you getting it now?)

“So if ALL mortgages are a “scam” – what’s the alternative?” Carlton asked. The banker laughed and laughed. When he finally caught his breath, he put his hand on Carlton’s shoulder and said…

“I like you Weiss, you know how to cut through the bulls*** and I like that. But if you think I’m going to just give away one of the biggest secrets in banking – you’ve got another thing coming.” The banker replied seriously.

Weiss left the dinner that night feeling unsatisfied but driven with curiosity.

Wittingly or unwittingly, the banker had revealed a HUGE truth about mortgages that only a small portion of the population is aware of…

Being the good private investigator he was, this lit a fire inside Weiss to uncover the truth behind mortgages and find the smarter alternative.

He started the search by talking with his friends that were in real estate…

He’d pick their brains asking them question after question trying to find this little-known alternative financing option the banker had eluded to.

To his surprise though, they had no idea what he was talking about. Mortgages and cash purchases were the only thing most of them were taught. (Mind you this was back in the early 70’s when this method wasn’t highly utilized.)

So he moved on to calling the banks directly – still no luck.

He’d hit a wall…

So Weiss kept investigating, learning everything he could from behind the scenes on what these wealthy individuals were doing when purchasing a home.

Carlton Finds The #1 Mortgage Alternative

After feeling a bit discouraged one night, Carlton decided to grab a glass of wine with a lender friend that worked at a nearby credit union.

Carlton explained his predicament and the mortgage alternative he was looking for…

“That sounds a lot like a Home Equity Line of Credit (HELOC) – but we usually only recommend something like that for people who are really struggling to make their mortgage payments – it’s not something we’d typically offer to the typical borrower.”

Carlton had found the answer!

A Home Equity Line of Credit.

The ability to tap into your home equity and use it like cash. Brilliant!

The next day Carlton went back to work – researching everything he could about Home Equity Lines of Credit. Now that he knew what they were called – a whole new world of information became available to him.

The Home Equity Line of Credit allows you to tap into your home equity and also repay on a revolving basis similar to a credit card.

A mortgage will never allow you to convert your home’s equity into cash because doing so would violate the terms of the Amortization Schedule.

With a HELOC you can avoid all the mortgage traps they set and also pay off your home in a fraction of the time!

While he wanted to get this news out to the public ASAP, there were still so many questions left to be answered like…

Why hadn’t he heard of this before? And why didn’t lenders promote it?

And also how much would this alternative financing method save versus a mortgage?

Carlton realized there was much more he needed to learn before telling the world.

So he took a step back and learned even more from the real estate, lending communities & what the ultra-wealthy individuals were doing.

He tracked & analyzed everything he could find…

Until eventually – he had an EPIPHANY…

This ONE THING he discovered is a total game-changer for homeowners & also allows one to reduce the cost of a 30-year mortgage by 50%.

Don’t worry – we’ll also tell you all about what he discovered in tomorrow’s email.

In the meantime, if you haven’t watched the entire Half Your Mortgage workshop – take some time for that now. It’s available for you to watch here.

Your friends in finance,

Private Wealth Academy

P.S. Wills just don’t work! Avoid probate court, inheritance taxes, greedy lawyers and family feuds by putting your home into a Bulletproof Trust. Protect your home and other assets from lawsuit while reducing your income tax liability too! Watch the FREE Bulletproof Trust Workshop Here.

P.S.S. Did you know unless you have a land patent – you don’t legally OWN your home?! It’s true! With Real Estate Secrets you can perfect your land patent, stop foreclosures and remove yourself from 100% of property taxes FOREVER. Watch the FREE Workshop Here to Learn How!

Information contained in our websites, products and emails does not constitute legal, financial or medical advice. With respect to any particular matter, students should seek legal advice from counsel in the relevant jurisdiction.

Leave a Reply

You must be logged in to post a comment.